Binance Coin (BNB) price has suffered a harsh reversal this week as sentiment in the crypto and stock industries worsened. The BNB token dipped to a low of 0 on Tuesday, down from an all-time high of 4.

Binance Coin token sold off this week as investors embraced a risk-off sentiment following last week’s strong nonfarm payrolls (NFP) data. The downturn coincides with Bitcoin gravitating towards the ,000 level while Ethereum dipped below ,500. The total market cap of all digital coins crashed by over 3% in the past 24 hours while the crypto fear and greed index has dropped to 60.

This decline is in part due to anticipation of Wednesday’s Federal Reserve decision. In it, analysts expect that the Federal Reserve will leave interest rates unchanged between 5.25% and 5.50%.

The central bank is also expected to hint that it will remain being data-dependent when deciding to cut interest rates. In his previous statements, Jerome Powell has said that the bank wants more evidence that inflation is moving towards its target of 2.0%.

Record high was brief

Binance Coin’s recent crash is a big reversal from what happened last week when it jumped to a record high of 5. At its peak, the token had a market cap of over 6 billion, making it bigger than well-known companies like Deere, KKR, Palo Alto Networks, and ADP.

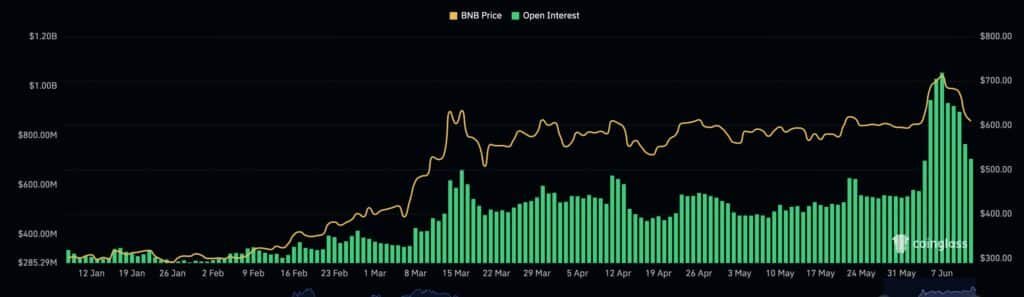

BNB token’s plunge has coincided with a drop in futures open interest, which have slumped from last week’s high of billion to 6 million.

Binance Coin price forecast

Binance Coin chart

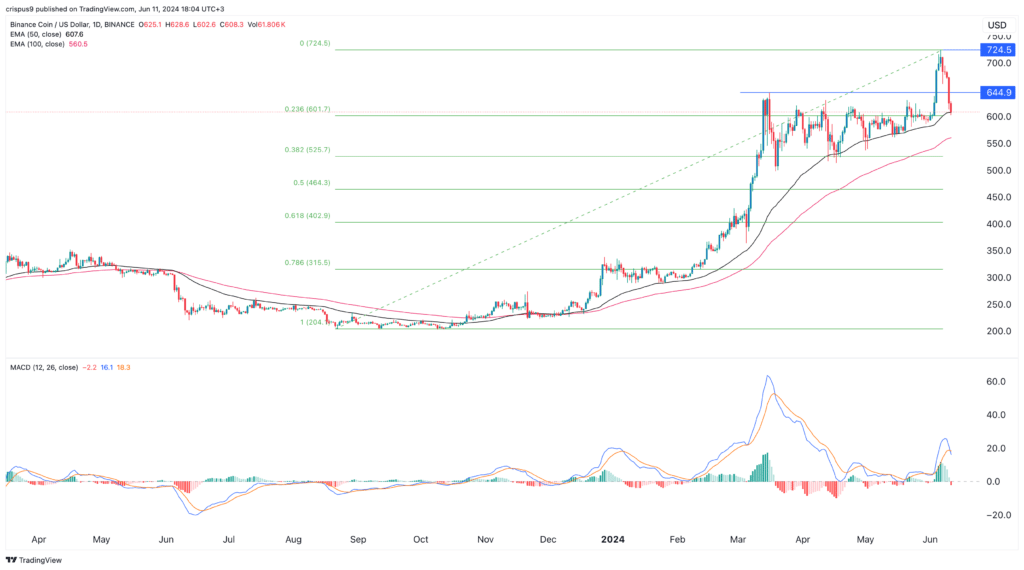

The daily chart reveals that the BNB token price has dived from last week’s 4 to the psychological level of 0. It has moved to the 23.6% Fibonacci Retracement point and crossed the key support level at 5, its highest point on March 16th.

Binance Coin has remained above the 50-day and 100-day Exponential Moving Averages (EMA) while the two lines of the MACD have formed a bearish crossover. The histogram has also dropped below the neutral level.

Therefore, the token will likely go through this shakeout for a while and then resume the bullish trend. If this happens, it will likely retest the all-time high of 5 either by the end of this week or next week.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News