EigenLayer’s token continued its strong recovery as investors bought the dip following last week’s airdrop.

EIGEN unlocks and TVL retreat

The EigenLayer (EIGEN) token rebounded, reaching a high of $3.86, its highest level since Oct. 2, and 26% above its all-time low.

EIGEN’s rebound occurred after the founder announced that the network was shifting focus to Web3 applications post-airdrop. This is important since EigenLayer does not have a consumer-facing application. Instead, it secures several actively validated services like AltLayer, Ethos, and Lagrange.

The rebound also came after a hacker stole 1,673,645 tokens valued at over $6.8 million. The hacker moved these tokens through a decentralized swap platform and then transferred the stablecoins to centralized exchanges.

EIGEN token holders face two significant risks ahead. First, there is a dilution risk since EigenLayer has 187 million tokens in circulation against a maximum cap of over 1.6 billion tokens.

According to the developers, the network will unlock and distribute 67 million tokens, or 4% of the initial supply, in the first year. These unlocks will happen every Tuesday over the next 12 months, with 3% going to Ethereum and liquid staking token stakers. 1% of the tokens will go to EIGEN stakers and operators.

Token unlocks are typically bearish because they increase the number of tokens in circulation, diluting existing holders.

The second risk is that demand for restaking is waning. According to DeFi Llama, EigenLayer’s total value locked has dropped to $10.7 billion, down from over $20 billion earlier this year. In Ethereum terms, the network secures 4.43 million Ethereum, down from the year-to-date high of 5.34 million.

A likely reason for this is that Ethereum (ETH) staking market cap has fallen in the past few weeks. It has retreated by almost 8% in the last 24 hours to $83 billion, according to StakingRewards.

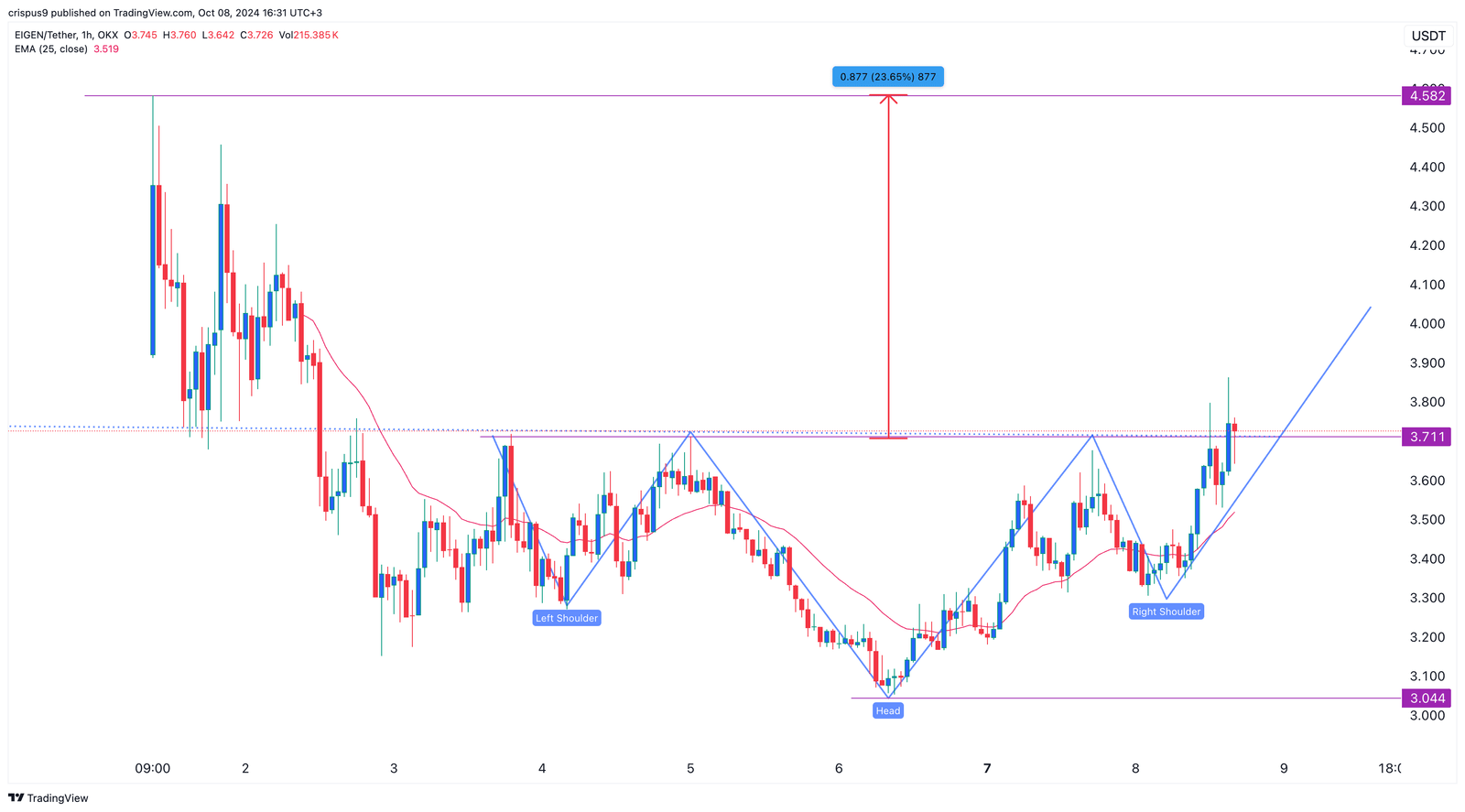

EIGEN forms an inverse H&S pattern

On the hourly chart, the EIGEN token bottomed at $3.04 on Oct. 6 and then bounced back to $3.8, its highest point since Oct. 2.

It has risen above the 25-period moving average, and most importantly, it has formed a bullish inverse head and shoulders pattern. In price action analysis, this is one of the most bullish signals in the market.

Therefore, there is a likelihood that EigenLayer’s token will bounce back and possibly retest the all-time high of $4.58, up by 23% from the current level.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News