These formulas we have been discovering are just building blocks in our search for intrinsic value and a margin of safety. CINF offers property and casualty insurance and has over 1% of the domestic property and casualty premiums in the US, which ranks as the 20th largest insurance company in the US by market share. Breaking it down means that if a company goes out of business, that would be the amount of money a shareholder would get once the company liquidates. It’s important to note that a change in asset quality can also impact book value per share.

Accounting Close Explained: A Comprehensive Guide to the Process

Please note that past performance of financial products and instruments does not necessarily indicate the prospects and performance thereof. A company’s future earnings potential is taken into consideration when calculating the market value per share (MVPS), as opposed to BVPS, which uses past expenses. To put it another way, a rise in the anticipated profits or growth rate of a business should raise the market value per share. Because they carry assets on the balance sheet at the original price minus depreciation, this could lead to underestimating the true economic value of the assets of the company.

- The book value per share would still be $1 even though the company’s assets have increased in value.

- Book value per share considers historical costs, whereas the market value per share is based on the company’s potential profitability.

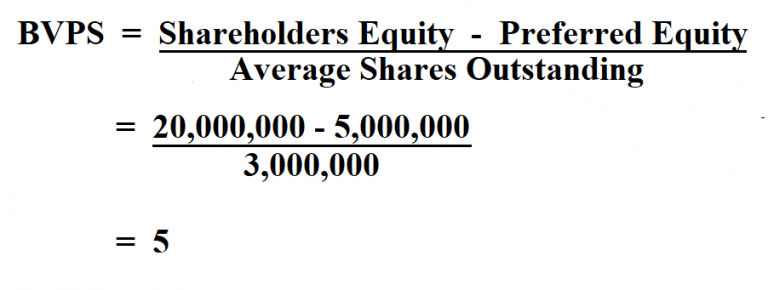

- To put it simply, this calculates a company’s per-share total assets less total liabilities.

- The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities.

Best Penny Stocks Under Rs. 10 – Based on Fundamental Factors

These write-offs could include bad debts, obsolete inventory, or impaired assets which might be tangible, like property or plant, or intangible like a patent or goodwill. The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding. Value investors look for relatively low book values (using metrics like P/B ratio or BVPS) but otherwise strong fundamentals in their quest to find undervalued companies.

Book Value Per Share: Formula & Basics for Beginner Investors

These measures must be used in conjunction, with an understanding of their limitations to generate a holistic understanding of a company’s financial health and investment potential. However, a high book value per share could also indicate a lack of re-investment. A company that fails to reinvest its earnings might have a high book value from accumulated earnings, but this could potentially harm future growth. High book value without reinvestment could indicate stagnation or lack of strategic planning.

How Does BVPS Differ from Market Value Per Share?

By multiplying the diluted share count of 1.4bn by the corresponding share price for the year, we can calculate the market capitalization for each year. The investors should make such investigations as it deems necessary to arrive at an independent evaluation of use of the trading platforms mentioned herein. The trading avenues discussed, or views expressed may not be suitable for all investors.

What Is Book Value Per Common Share?

However, because assets would hypothetically sell at market value instead of historical asset values, this may not be an entirely accurate measurement. Nevertheless, most companies with expectations to grow and produce profits in the future will have a book value of equity per share lower than their current publicly traded market share price. Often called shareholders equity, the “book value of equity” is an accrual accounting-based metric prepared for bookkeeping purposes and recorded on the balance sheet. If a company’s share price falls below its BVPS, a corporate raider could make a risk-free profit by buying the company and liquidating it. If book value is negative, where a company’s liabilities exceed its assets, this is known as a balance sheet insolvency. Book value per equity share indicates a firm’s net asset value on a per-share basis.

If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. BVPS is what shareholders receive if the firm is liquidated, all tangible assets are sold, and all liabilities are paid. Perhaps one of the most significant limitations of BVPS is that it often fails to account for the true value of intangible assets. Book value is calculated based on the reported value of a company’s tangible assets – such as buildings, equipment, and inventories – minus any liabilities.

When the price that you pay for a share is close to or below its book value, it limits the potential downside of an investment, although it doesn’t exclude it. If the company’s book value is consistently decreasing, it’s often a red flag that the company’s liabilities are increasing, or its assets are deteriorating. Inversely, if a company does not pay dividends and retains its profits, it may result in the definition of net credit sales on a balance sheet chron com an increased book value per share, as those retained earnings will add to the net assets of the company. A write-off, which is the reduction of the value of an asset or earnings by the amount of an expense or loss, can significantly impact the book value per share. If assets become worthless and are written-off, it would decrease the company’s net assets, therefore, lowering the book value per share.