Bitfarms sold over 60% of August Bitcoin production amid rising network difficulty.

Canadian Bitcoin (BTC) miner Bitfarms announced that it sold nearly 63% of the Bitcoin it mined in August, amounting to 147 BTC out of the 233 BTC generated during the month.

In its August 2024 update, the Toronto-based company highlighted the sale as part of its ongoing focus on active treasury management amid the “increase in average network difficulty.”

The sale generated approximately $8.8 million in revenue, contributing to Bitfarms’ liquidity while allowing the company to grow its Bitcoin holdings. Despite the challenging conditions, Bitfarms added 86 BTC to its treasury, bringing the total to 1,103 BTC, valued at approximately $65.1 million as of Aug. 31, 2024.

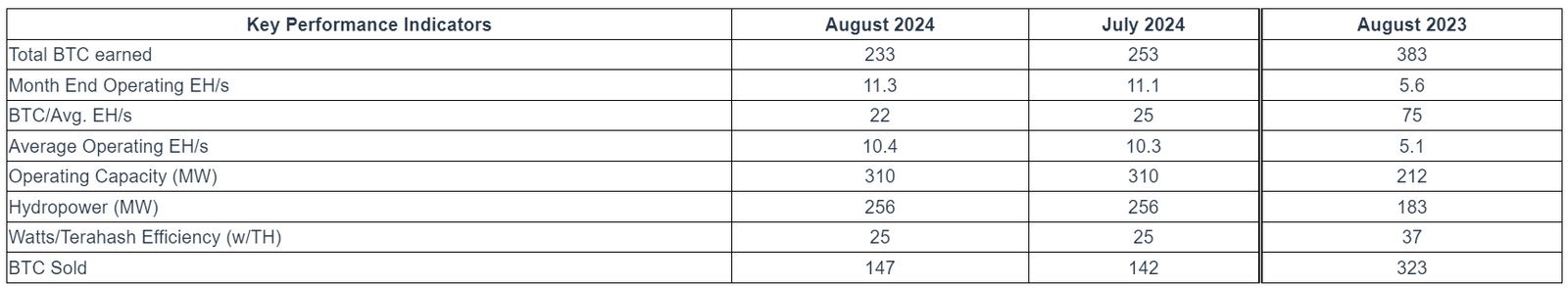

August marked a particularly difficult month for Bitfarms, with the network difficulty decreasing by 1.3%, a modest reprieve after months of escalating challenges. The company’s total Bitcoin production dropped to 233 BTC, down 8% from July’s 253 BTC and nearly a 40% year-over-year decline from August 2023’s 383 BTC.

The reduction in output was partially offset by Bitfarms’ ongoing efforts to optimize its mining operations. The company received and began installing 2,744 new T21 miners from Bitmain, replacing underperforming units. By the end of August, Bitfarms’ operational capacity reached 11.3 EH/s, a 102% increase year-over-year and a 2% gain compared to July.

Bitfarms braces for future prospects

As the Bitcoin network continues to evolve, Bitfarms aims to position itself to adapt to the shifting landscape. The average operating efficiency remained at 25 watts per terahash, according to the report. However, the decline in BTC per average EH/s — from 25 BTC in July to 22 BTC in August — reflects the ongoing challenge of rising network difficulty.

The report comes as its key rival, Riot Platforms, urged Bitfarms’ shareholders in a public statement to support changes to Bitfarms’ board at an upcoming Oct. 29 meeting, citing concerns over “broken governance.”

In the statement, Riot criticized Bitfarms for what it described as “defensive” tactics to entrench the existing board, including a recently announced acquisition of Stronghold Digital Mining Inc. The company also questioned the timing and terms of the $175 million deal, suggesting it was engineered to benefit legacy directors “whose focus is maintaining their own positions.”

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News