Monero is showing early signs of recovery, posting a 5% gain in the past 24 hours and emerging as one of the market’s top performers.

At the time of writing, Monero (XMR) was trading at $146.63, with a market cap of $2.7 billion, offering some relief to investors after a volatile start to October. After starting the month at $153.8, XMR saw a sharp decline, dropping to $142.96 on Oct. 2 and spiraling further to its lowest point at $136.43 the following day.

The plunge coincided with the announcement that Kraken, a major cryptocurrency exchange, would delist Monero in the European Economic Area to comply with local regulations, likely in anticipation of the upcoming Markets in Crypto-Assets Act set to take effect in December.

Kraken delisting fuels downtrend

Kraken’s decision to delist Monero in the EEA sent shockwaves through the market, raising concerns about regulatory scrutiny surrounding privacy coins. Monero’s privacy-focused technology, which obfuscates transaction details, has long drawn regulatory attention, and the looming MiCA framework appears to be tightening the noose further.

What raised eyebrows, however, was the timing of Monero’s price drop. There are allegations that XMR started to sell off before Kraken’s delisting announcement, sparking speculation that insiders may have acted on non-public information. This is particularly suspicious as the broader cryptocurrency market was rallying at the time, yet Monero bucked the trend with a sharp downward move.

Despite the regulatory hurdles Monero faces, advocates of privacy coins remain optimistic. Many argue that Monero’s use case, centered around anonymous transactions, ensures its relevance regardless of exchange delistings.

According to one Monero proponent going by ‘Klaus’, “Regardless of if it maintains this price or goes below a dollar, best believe whales will be using this technology to funnel their wealth.”

That said, the token has yet to fully recover from its October lows, and trading volume remains subdued. XMR’s daily trading volume has fallen 24.5%, hovering around $67.8 million — showing signs of waning trader interest.

XMR testing key resistance levels

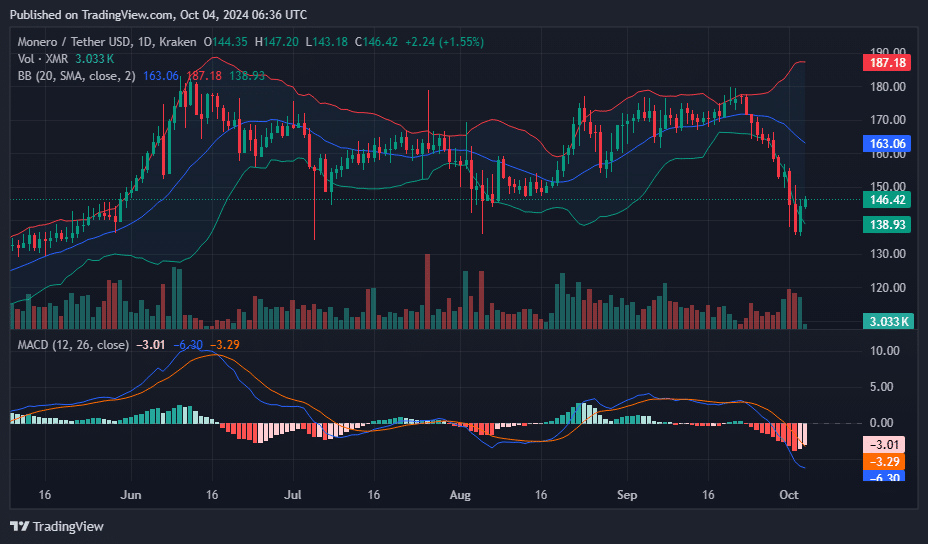

From a technical perspective, Monero has rebounded from a crucial support level at $134, a level that has held since early July. The bounce has lifted XMR back above the lower Bollinger Band, and the next significant hurdle lies at $163, the midline of the Bollinger Bands. To confirm a sustained bullish reversal, Monero must clear this level with strong momentum.

Beyond $163, the psychological resistance at $180 looms as a formidable barrier, having rejected upward price movements in both June and September. Breaking through these levels would be key for Monero to re-establish a stronger bullish trajectory.

Technical indicators also paint a cautiously optimistic picture as the Moving Average Convergence Divergence remains in bearish territory, with the MACD line still below the signal line. However, the two lines are converging, hinting the momentum could shift soon.

The histogram remains in the red hinting that selling pressure might be fading, and bulls could soon be in control. Volume levels, though stable as of press time, remain insufficient to signal a decisive bullish move. A stronger uptick in volume will be necessary for Monero to gain the traction needed for a more robust recovery.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News