Ukraine remains among the top countries in terms of cryptocurrency adoption. How does mining work in the country during the current conflict with Russia?

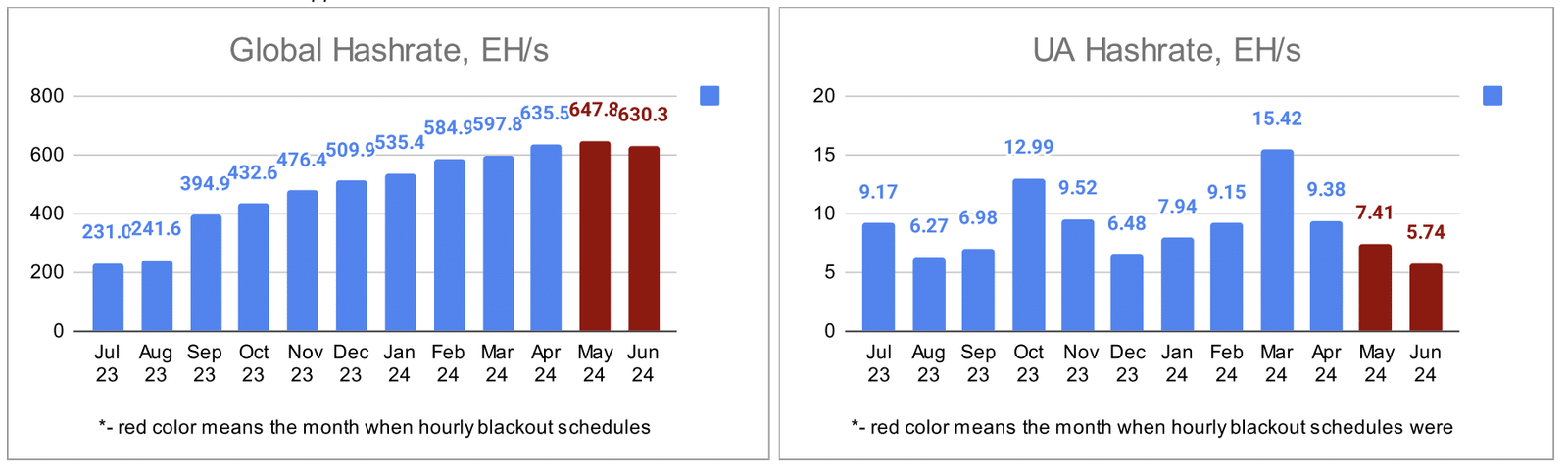

Analysts at the OSINT agency Molfar collected data from July 2023 to June 2024 using various open sources, including archival information and mining pool hashrates. As a result, the experts determined the average hashrate by month.

The study found three active mining pools with six miners in Ukraine, which likely consumed 33 kW per hour. Also, from the resource asictrade.com, 146 types of miners (mining systems) are known.

Table of Contents

How much Electricity do mining farms consume in Ukraine?

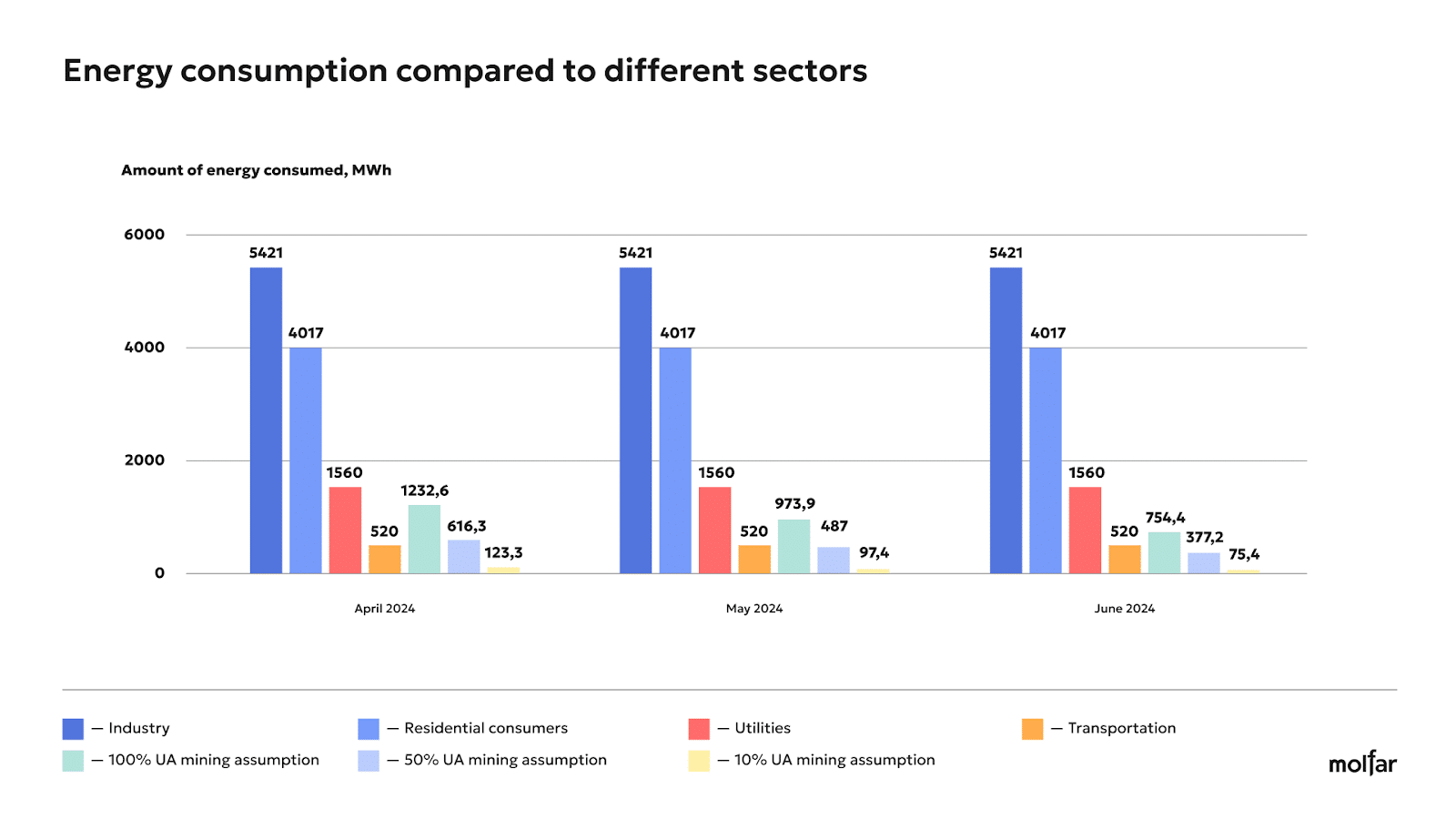

The report shows that Ukrainian miners consumed an average of 616 MW per hour in April and 487 MW per hour in May. Depending on production volumes, a steel mill can consume between 200 and 1,000 MW per hour.

Ukrainian miners’ electricity consumption in April and May 2024 equaled or exceeded that of large industrial enterprises. This is despite the fact that cryptocurrency mining is a relatively new industry.

Ukraine’s total electricity consumption in 2023 was about 15 GW per hour. At the same time, the current deficit is 9 GW. In March 2024, about 6.7% of the country’s total electricity consumption was consumed by miners.

However, compared to global indicators, this is a small amount. For example, in the U.S., miners consume about 8-10 GW of electricity per hour. Thus, Ukrainian miners’ electricity consumption in March 2024 was only 10% of what miners in the U.S. consumed.

The hash rate and electricity consumption decrease in warmer months, such as June and August. This is because the costs of cooling mining devices increase. Mining becomes less profitable, so fewer people are engaged in it.

Bitcoin mining and household electricity consumption

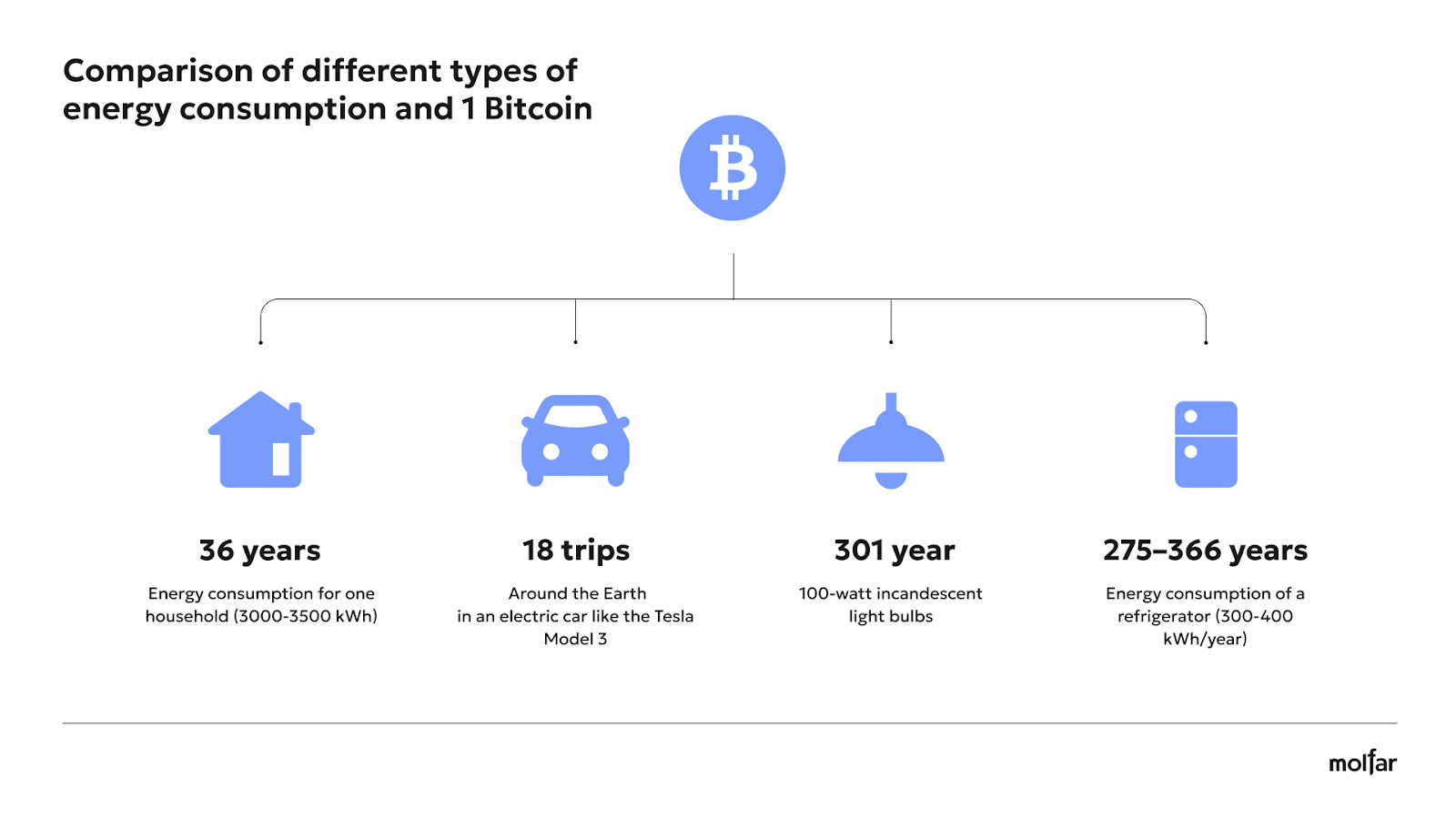

The average cost of electricity required to mine one Bitcoin (BTC) is $46,291. On the market, its price at the beginning of September was $58,000 at the time of the study. Costs and profits will vary in different regions of the world.

Mining one BTC requires approximately 110,000 kWh. At the same time, the total consumption of the Bitcoin network is estimated at 176.02 TWh per year. Therefore, if calculated based on prices for consumers in Ukraine, the cost of one BTC will be $12,540.

“Of course, this calculation does not take into account other expenses, such as equipment and its depreciation.”

Estimation of electricity consumption by miners and infrastructure

According to the study, the average volume of electricity consumption by miners from April to June was equal to the needs of 658 hospitals, 3.5 million units of street lighting, more than 36,000 stores, and more than half a million air conditioners.

In addition, the level of energy consumed by miners would be enough to supply the largest Ukrainian cities for several days.

“The daily rate of electricity consumption by the miners (9052 MW per day) allowed for 3.89 days without outages in Kyiv and Dnipro. 1 day of mining covers 4 days of no power outage in Kyiv and Dnipro.”

Maksym Zrazhevskyi, Head of Research at the OSINT agency Molfar, in conversation with crypto.news notes that miners’ consumption significantly affects the operation of Ukraine’s infrastructure. Electricity consumption by miners is especially negative in the evening when electricity consumption by the country’s population reaches its peak.

Thus, miners are harming the country since the estimated electricity consumption by miners is comparable to the consumption of, for example, 770 hospitals — infrastructure vital for the country during a wartime.

“However, if the situation with power generation improves along with the conditions for legal mining business, mining may well become a boon for post-war Ukraine.”

Legal status of crypto in Ukraine

In February 2022, Ukrainian President Volodymyr Zelensky signed the law on virtual assets. According to the new rules, the National Securities and Stock Market Commission would regulate the crypto market. At the same time, mining is not prohibited in Ukraine. In fact, it is an activity involving the use of equipment to obtain assets.

However, crypto regulation in Ukraine has yet to be fully established. In March, the Ukrainian government approved a reform plan within the framework of the Ukraine Facility program, ensuring the receipt of €50 billion from the EU during 2024-2027. The document, among other things, contains provisions on the cryptocurrency market.

To combat illegal activities, the government emphasized the need to amend the relevant law on virtual assets to take into account the provisions of MiCA (Markets in Crypto-Assets) and the adoption of taxation of the crypto market.

Meanwhile, since the beginning of the conflict with Russia, cryptocurrencies have become especially popular in Ukraine, including due to the simple collection of donations for the Armed Forces’ needs.

Prospects and difficulties in developing mining in Ukraine

Analysts note that the conflict with Russia has further aggravated the situation with cryptocurrency mining. If, at the end of 2021, it was planned to build mining centers around nuclear power plants with a capacity of 2-3 GW, then in 2024, such plans look ghostly.

“The current state of Ukraine’s energy system raises questions about the profitability of this industry. We see that the electricity costs for mining are generally much higher than the energy limits provided to cities like Dnipro and Kyiv. However, miners could theoretically solve this problem using solar or wind power plants.”

However, Zrazhevskyi is confident that the country has prospects for mining development since Ukrainians are very passionate about cryptocurrencies. They often choose cryptocurrency as a means of protecting their savings. In addition, the low price of electricity makes the country attractive for mining development.

“Ukrainians are actively involved in the cryptocurrency sphere, and together with cheap electricity the country has high prospects for becoming a major hub in the world of cryptocurrencies. At the moment, the main obstacles in Ukraine are power outages as well as imperfect legislation.”

At the same time, As for legislation, initiatives are already being considered in Ukraine that will allow for the regulation of the cryptocurrency market in the future, including mining, he concluded.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News