Bitcoin briefly touched a local high of $60,100 earlier today and is currently hovering at around $58,894 at last check Sunday.

The leading cryptocurrency is up for three straight days, but still in a consolidation phase.

Bitcoin (BTC) daily trading volume decreased by 42% and is currently hovering around $14.7 billion.

When an asset’s trading volume declines, it’s usually a sign of a cool-down and lower price volatility.

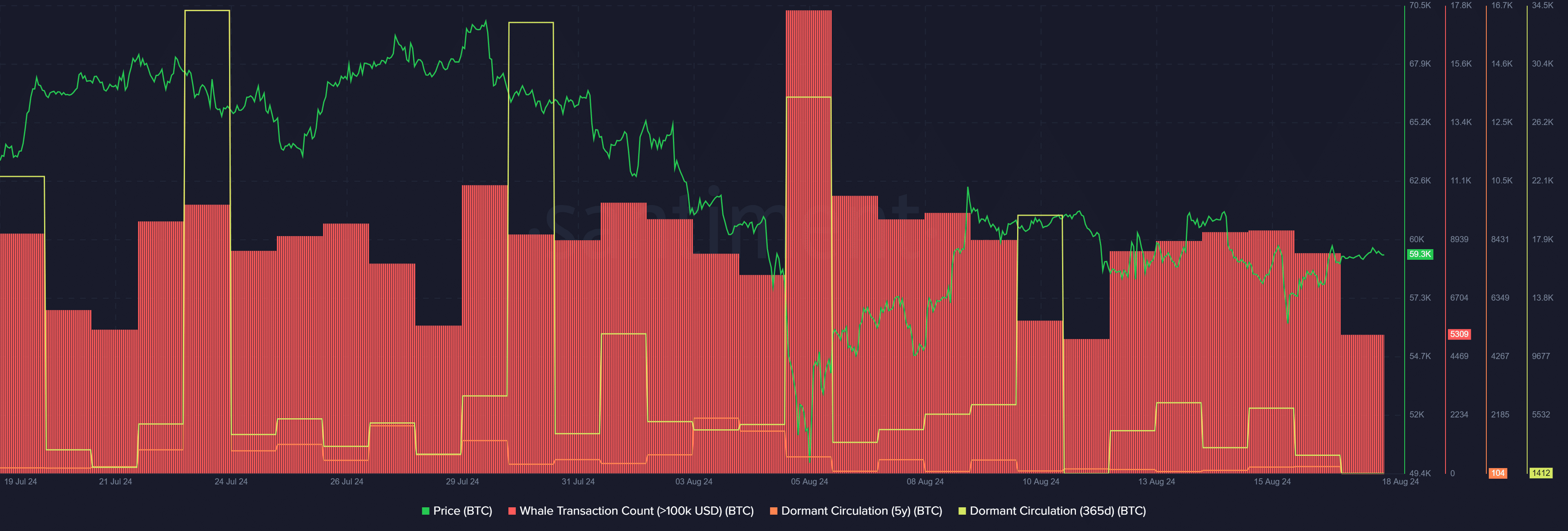

According to data provided by Santiment, Bitcoin’s five-year dormant circulation is currently sitting at 104 BTC, one of the lowest levels seen this year.

Notably, this metric rose to 16,592 BTC on July 23 when the Bitcoin price was hovering around the $66,000 mark.

Moreover, the asset’s one-year dormant circulation plunged from 6,040 BTC on Aug. 15 to 1,412 BTC at the reporting time.

The declining dormant circulation often hints at long-term holders’ profit-taking and is usually increased during high price points. At this point, long-term Bitcoin addresses have either taken profits or gone back to sleep.

Per data from Santiment, the number of whale transactions consisting of at least $100,000 worth of BTC has been consistently decreasing over the past three days — dropping from 9,295 on Aug. 15 to 5,309 unique transactions at the reporting time.

Declining whale activity often decreases an asset’s price volatility as token holders expect a lower chance of whale price manipulations.

According to a crypto.news report on Aug. 17, spot Bitcoin exchange-traded funds in the U.S. closed the week with over $36 million in net inflows. This was one of the main reasons behind the bullish sentiment around BTC that helped it recover the $59,000 mark.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News