Colorado-headquartered crypto mining company Riot Platforms has acquired ownership of a 12% stake in rival Bitfarms despite shorting pressure from Kerrisdale Capital.

Bitcoin mining company Riot Platforms said in a press release on Jun. 5 it acquired 1,460,278 common shares of Bitfarms, becoming the beneficial owner of approximately 12%. The company said the latest purchase, at .45 per share, cost Riot over .5 million in total.

Following the acquisition, Riot stated its intention to call a special meeting of Bitfarms’ shareholders. At this meeting, Riot plans to nominate “several well-qualified and independent directors” to the Bitfarms board, citing “serious concerns regarding the board’s track record of poor corporate governance.”

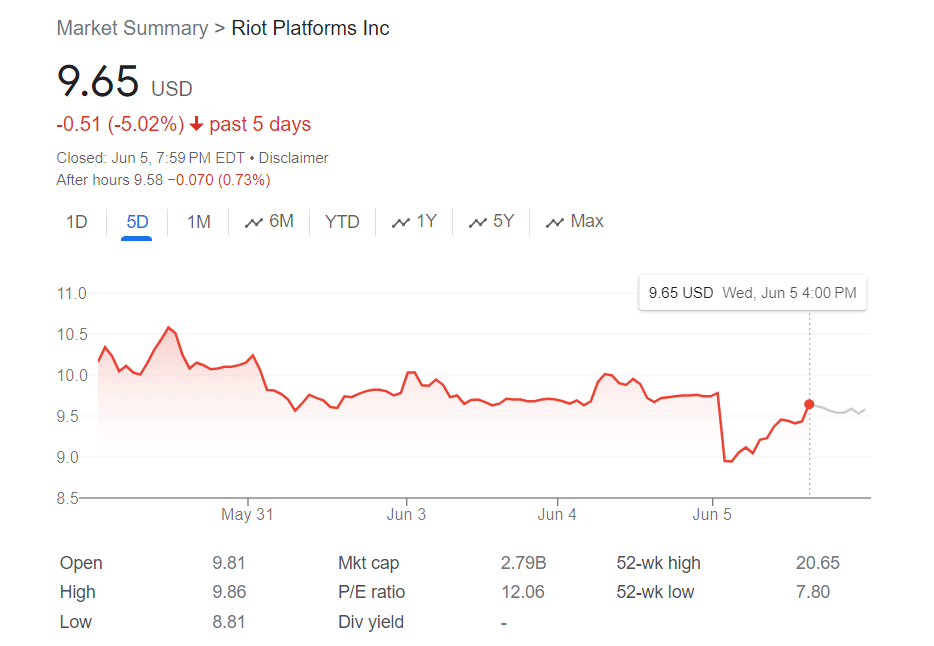

This move comes amid shorting pressure from Kerrisdale Capital, which recently disclosed a short position in Riot, citing issues with Riot’s equipment sourced from China and operational concerns, and causing Riot’s shares to drop by as much as 9% to .84. However, Riot’s share price rebounded to .65 following the announcement of its additional Bitfarms share purchase, according to Google Finance data.

In late May, Riot announced a 0 million acquisition bid for Bitfarms, alleging that Bitfarms’ founders weren’t acting in the best interests of all shareholders. Riot claims its proposal, initially submitted privately in late April, was rejected by the Bitfarms board without substantive engagement.

Bitfarms responded by stating that Riot’s offer “significantly undervalues” its growth prospects. The company added that a special committee had requested “customary confidentiality and non-solicitation protections” to which Riot didn’t respond.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News