Recent data from CryptoQuant indicates that Bitcoin’s buy walls have attained massive strength across all exchanges.

These buy walls are now sufficient to counteract the sell pressure, as the market looks to recover. This suggests that there is robust demand for Bitcoin (BTC), enough to absorb the selling volume that could otherwise continue to push prices down.

The chart, covering the period from early 2023 to mid-October 2024, shows that while Bitcoin faced intense sell pressure over the past few months, recent weeks have shown a reversal in this trend.

As of Oct. 12, buy walls for Bitcoin reached a strong level of 895 million while sell walls dropped to zero. This implies that buyers are willing to step in at important levels, with the recent drop in exchange reserve confirming this trend.

The strong buy walls also indicate a growing confidence. When buy walls outweigh sell walls, prices tend to stabilize or rise. If this trend persists, Bitcoin could see further upward momentum, depending on liquidity and investor sentiment.

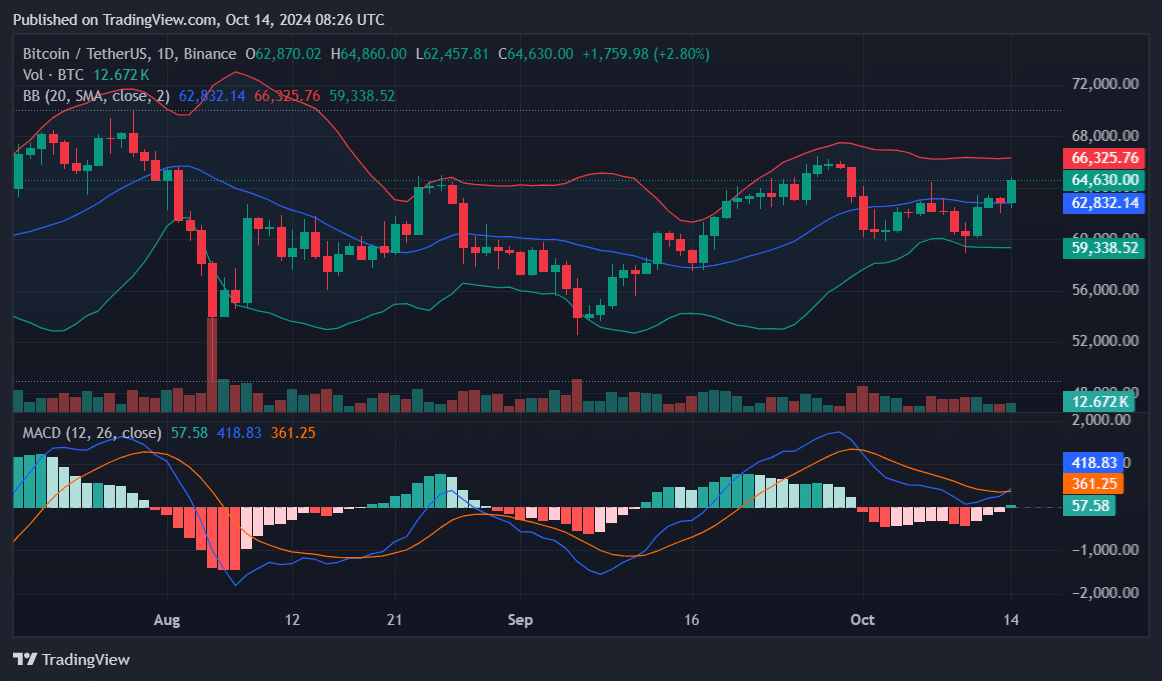

Notably, after struggling on Sunday, the firstborn cryptocurrency has begun the new week on a strong footing. Bitcoin is up by 2.80% in the past 24 hours and is trading at $64,630 at the time of writing.

The MACD indicator has just flipped bullish, signaling renewed buying momentum. BTC faces strong resistance at the upper Bollinger Band of $66,325. A breakout above this level could see the asset push toward $68,000 or higher in the short term.

Meanwhile, the 20-day moving average provides support at $62,832, with the lower Bollinger Band at $59,338 presenting additional support. Given the bullish MACD crossover and the recent rise in buy walls, Bitcoin appears poised for further upside, provided it can break through its current resistance.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News