What are the immediate global triggers that have led to this massive crypto market crash? Read on

Table of Contents

The crypto market has crashed brutally, sending shockwaves through the financial world. As of August 5, the global crypto market cap stands at $1.81 trillion, a staggering 15.88% decrease in just one day, triggering extreme panic and strong indications of a bear market.

Bitcoin (BTC) has plummeted over 25% in the last seven days, with nearly 15% of that decline occurring in the last 24 hours, trading at $51,300 levels as of August 5.

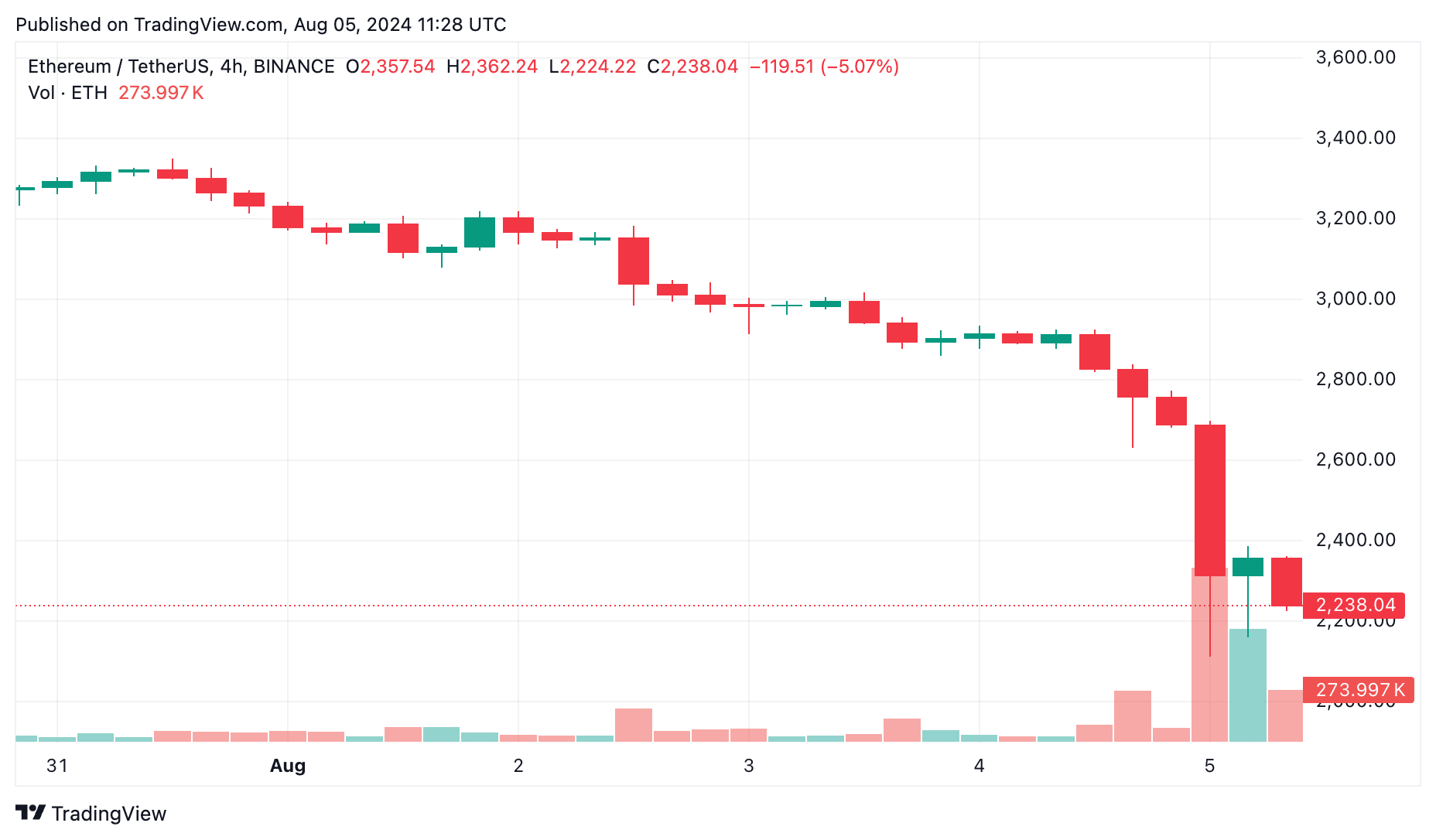

Ethereum (ETH) has fared even worse, falling by 32% in the last week and over 21% in the past day, trading at $2,238 levels as of this writing.

Other altcoins have been hit hard, too, dropping between 40-50% over the week and 15-25% in the last 24 hours.

The turbulence isn’t limited to the crypto market. Major global stock indices like NASDAQ100 (U.S.), FTSE100 (UK), and NIFTY50 (India) have seen sharp declines of 2-3% in a single trading session.

Japan’s Nikkei225 took the worst hit, plunging nearly 14% in one day, marking its steepest decline since 1987.

So, why is crypto crashing right now? What are the global triggers causing this widespread panic and dragging down all financial markets? Let’s delve into the underlying reasons behind this market turmoil.

What happened to crypto market: decoding the factors

U.S recession fears

The crypto market’s recent crash isn’t happening in isolation. The U.S. job market is showing signs of trouble, which is fueling fears of a recession.

According to data released on August 2, the unemployment rate jumped to a nearly three-year high of 4.3 percent in July, up from 4.1 percent in June and a stark increase from a five-decade low of 3.4 percent in April last year.

Economists from Goldman Sachs have increased the probability of a recession in the U.S. next year to 25 percent from 15 percent, Bloomberg reported.

Despite this, they noted there are “several reasons not to fear a slump,” even with the jump in unemployment. According to Goldman economists, ‘The economy continues to look fine overall, there are no major financial imbalances and the Fed has a lot of room to cut interest rates and can do so quickly if needed.’

However, there are also concerns that the Federal Reserve may have “waited too long” to cut interest rates. The Goldman report suggests that if job growth recovers in August, a 25 basis points (bps) cut would be sufficient to address any downside risks. But if the August employment report is as weak as July’s, a 50 bps cut might be necessary in September.

The rising unemployment and potential recession fears are creating a ripple effect. Investors are becoming more risk-averse, moving away from volatile assets like crypto, leading to massive sell-offs in the crypto space.

When people fear a recession, they tend to sell off riskier investments and hold onto safer assets like cash, gold, or government bonds.

Nikkei 225 crash

Japan’s financial system is undergoing some critical changes, and these shifts are having a ripple effect on markets worldwide.

On July 31, Japan’s central bank raised its benchmark interest rate to “around 0.25%” from its previous range of 0% to 0.1%. This was the second time this year that the Bank of Japan (BoJ) increased rates, the first being on March 19, marking the first rate hike since 2007.

While this move is aimed at benefiting Japan’s economy, it has an adverse impact on carry trade, a popular strategy among forex traders and fund managers.

Carry trade involves borrowing money in a currency with a low-interest rate and investing it in assets that offer higher returns. When Japan raises its interest rates, it makes the yen more attractive for borrowing, disrupting this strategy and causing global financial adjustments.

The effect of Japan’s rate hike was immediately felt. The Nikkei 225 stock index plunged 12.4% on August 5, marking a widespread sell-off.

One of the factors driving the BoJ to raise rates was the prolonged weakness in the Japanese yen, which has pushed inflation above the central bank’s 2% target.

Early on August 5, the dollar was trading at 142.59 yen, down from 146.45 late Friday and sharply below its level of over 160 yen a few weeks ago.

The market sell-off in Japan is not occurring in isolation. Stocks began tumbling globally on August 2 after weaker-than-expected data on U.S. jobs sparked worries that high interest rates might push the U.S. economy into a recession.

This anxiety is compounded by Japan’s rate hike, which adds another layer of complexity to the global financial picture.

The current scenario, where both U.S. and Japanese markets are showing signs of stress, is causing investors to reassess their positions. As a result, there is a massive sell-off in riskier assets, including cryptocurrencies.

Geopolitical woes

Geopolitical tensions are another major factor impacting the crypto market. On August 3, tensions in the Middle East escalated as Iran and its allies prepared their response to the assassination of Hamas leader Ismail Haniyeh in Tehran, an act they blamed on Israel.

This followed the killing of Hezbollah’s military chief in Beirut, prompting vows of vengeance from Iran and the ‘axis of resistance’, which raised fears of a regional war.

Meanwhile, the U.S., an ally of Israel, announced it would move warships and fighter jets to the region. Western governments urged their citizens to leave Lebanon, where the powerful Iran-backed Hezbollah movement is based, and airlines canceled flights.

Iran-backed groups from Lebanon, Yemen, Iraq, and Syria have already been drawn into the ongoing conflict between Israel and the Palestinian militant group Hamas in Gaza.

The fear of a regional war and its potential global implications can lead to massive sell-offs in the crypto market as investors seek stability. Geopolitical instability often causes heightened volatility in both traditional and crypto markets.

What’s next?

As the crypto market continues to tumble, let’s explore the insights of some prominent figures in the industry and analyze their perspectives on the situation.

Alex Krüger, a well-known macroeconomist, suggests that the current debacle is driven more by macroeconomic factors rather than issues specific to crypto.

Krüger argues that the policy mistake wasn’t the Fed not cutting rates quickly enough, but rather the Fed not cutting rates while Japan hiked theirs, creating a financial crisis spurred by levered Japanese speculators, which, according to him, is a less severe scenario than a crisis caused by a U.S. recession.

Meanwhile, Justin Sun, the founder of Tron (TRX), remains optimistic despite the market downturn. He suggests that the industry has grown over the past year and that the current market fluctuations aren’t due to negative news.

In these turbulent times, you should exercise caution and stay informed. Diversify your portfolio to mitigate risks and avoid putting all your eggs in one basket.

Consider setting stop-loss orders to protect your investments from further decline. Don’t make impulsive decisions based on fear or market hype, and never invest more than you can afford to lose.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News