ZKsync, the Ethereum-based layer-2 blockchain platform, has witnessed a significant 21% drop in its token value following the recent airdrop, as selling pressure mounts.

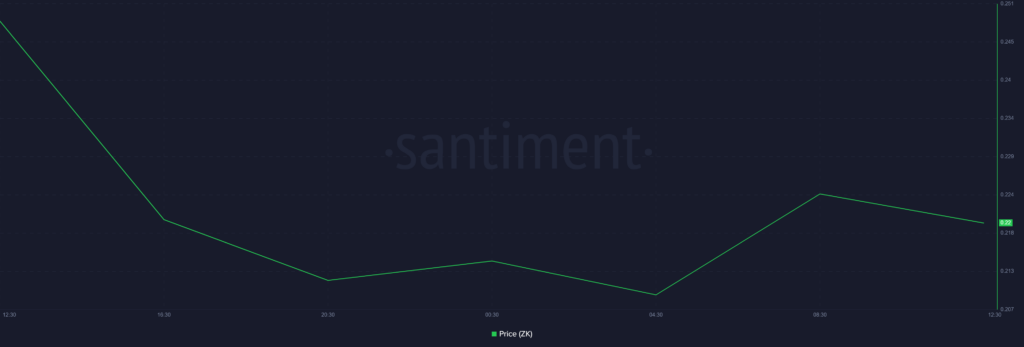

The much-anticipated distribution of “ZK” tokens initially placed the market capitalization of the asset near an impressive 0 million, per market data. However, the excitement was short-lived as the token’s value has plummeted by 21% since then and 26% from its peak of .3098.

Notably, the ZKsync team executed the token airdrop on Jun. 17 following the initial controversy, with Binance immediately announcing the token’s listing, a move that provided a venue with ample liquidity for trading activity.

ZKsync is down by 21.76% in the past 24 hours and is trading at .2245 at the time of writing. Trade volume has spiked 1,970% to .3 billion in the last 24 hours, reflecting surging trading activity. The token’s market cap currently sits at 1 million.

The decline in value is attributed to the immediate sell-off by airdrop recipients, reflecting a common trend observed in the crypto market where beneficiaries rush to liquidate their holdings for quick gains. This rush to sell, especially with sufficient liquidity on platforms like Binance, has exerted considerable downward pressure on the token’s price.

This pattern was observed with Notcoin (NOT) following its airdrop last month. Notably, NOT collapsed by nearly 40% a week after its airdrop due to a surge in selling pressure. Interestingly, the token has recovered from this drop, now up 134% over the past month.

However, there is no guarantee that ZKsync would follow a similar trajectory. Despite technical issues and backlash regarding its token distribution strategy, nearly half of the ZK tokens were claimed shortly after the airdrop commenced.

The platform’s technical challenges and concerns over Sybil attacks — where one user creates multiple accounts to receive more tokens — cast shadows over the event.

The initial response from the crypto community was one of enthusiasm, with pre-market pricing on perpetual exchange Aevo valuing ZK at .67 at some point, which would place the airdrop’s fully diluted value (FDV) above .41 billion. However, this sentiment quickly shifted as selling pressure took hold.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News