Altcoins face an early crypto winter, mainly due to the large token unlocks in 2024.

Table of Contents

According to Bloomberg, early project investors seek to sell the received tokens quickly, wanting to lock in short-term profits. At the same time, they do not want to keep unlocked altcoins on their balance sheets, with an eye to future growth.

Data from the Token Unlocks platform, which tracks 138 projects, indicates that 120 are expected to unlock tokens in 2024. Analysts estimate the total market value of this volume of assets to be $58 billion.

Edward Chin, co-founder of the investment company Parataxis Capital, believes that massive sales of such assets are putting intense pressure on the altcoin market. At the same time, brokers often need to offer potential buyers tokens from early investors at a discount of up to 40%.

“The market is strange at the moment, in that the many infrastructure projects that investors funded over the bear market are now coming to their token launch, but there is not a ton of regular buyers of these tokens at high prices.”

Lex Sokolin, Generative Ventures co-founder

How does unlocking affect tokens?

The timing and scale of token unlocking can significantly impact market dynamics. Unlocking many tokens simultaneously can reduce interest in purchasing and temporarily drop token prices.

Token unlocking events can cause market fluctuations as investors react to the new supply of tokens. Investors may adjust their positions based on the unlock schedule and the expected impact on token prices, resulting in price changes.

Which tokens collapsed after unlocking?

For example, the token of the dYdX project, DYDX, has dropped by 61% over the past three months. At the time of writing, the asset price is $1.4, and its market capitalization is $838 million.

A similar situation is observed in the Pyth Network (PYTH) and Avalanche (AVAX) projects. Over the same period, their tokens fell by 55% and 66%, respectively.

All three listed projects were unlocked in May 2024. The general market volatility aggravates the situation with altcoins. Of the more than 90 most considerable crypto assets by market capitalization, only 12 have shown positive returns since mid-March 2024.

According to statistics, about 80 projects show negative dynamics in this indicator. At the same time, the price of 23 assets fell by more than 50%.

Crypto winter on the altcoin market

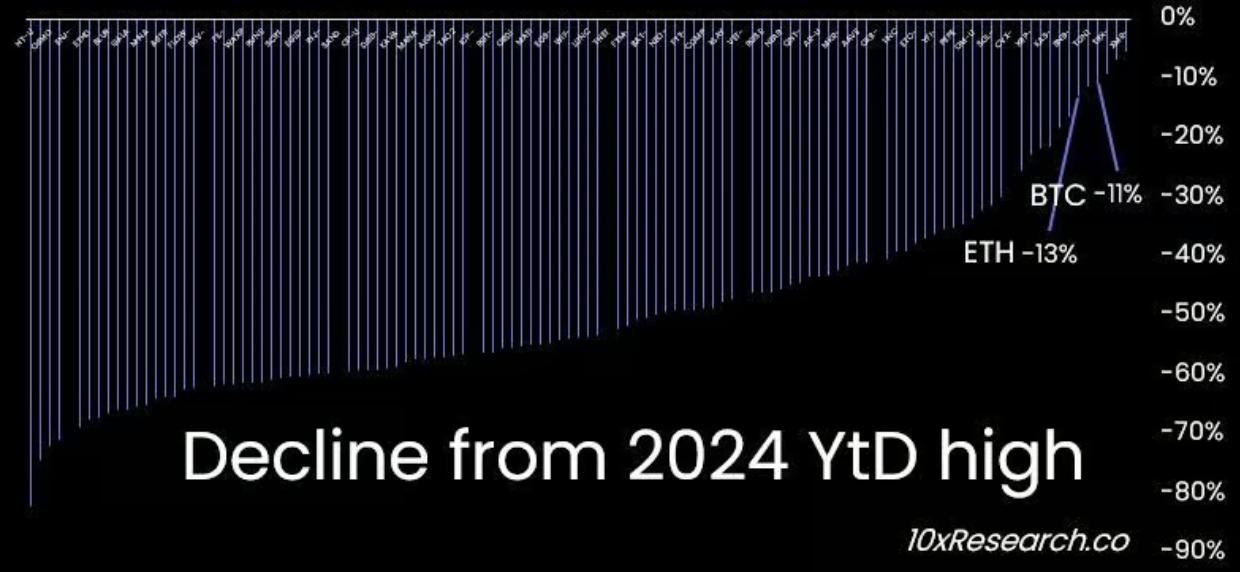

10xResearch analysts note that the 115 most prominent altcoins have fallen in price by more than 50% since their 2024 peaks. This correction is mainly similar to the declines seen in previous market cycles in 2017 and 2021. Without an influx of new funds and restoration of liquidity, the fall in altcoin prices may continue.

“Today, altcoins are in a brutal bear market. In 2024, 73% of those 115 coins peaked in March. We have been correct in calling for Bitcoin’s outperformance against everything else, notably Ethereum, but in early March, the game changed.”

10xResearch

While altcoins are falling, the two flagship cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), have shown relative resilience. They are down 11% and 13%, respectively, from their peaks this year.

“Surviving the altcoin bear market hinges on one crucial factor: effective risk management. Token unlocks, and unfavorable crypto liquidity indicators are the primary catalysts of this altcoin crash.”

10xResearch

In May, analysts warned about a potential decline in altcoin prices due to unlocking a significant volume of tokens. Almost $2 billion in unlocked tokens is expected to enter the market before July, which could lead to a sell-off of cryptocurrencies and a drop in prices.

According to experts, this situation is due to the actions of venture capital funds. In the first quarter of 2022, these funds invested $13 billion in altcoins. Under pressure from investors wanting to return their funds, venture funds are forced to sell their tokens. The situation is aggravated by investors’ growing interest in artificial intelligence (AI).

Should traders wait for the altcoin season?

The share of Bitcoin in the total capitalization of the entire crypto market, whose volume is $2.4 trillion, is at 54.6%. The so-called Bitcoin Dominance Index indicates the market cycle and investor sentiment, with smaller cryptocurrencies typically outperforming Bitcoin and Ethereum in growth rates.

As a rule, the share of the leading digital currency in the total capitalization of the entire crypto market grows during cyclical downturns in the industry. During a bull period in the market, when many altcoins grow faster than Bitcoin, it decreases. Thus, the first cryptocurrency dominance index indicates the market cycle and investor sentiment.

Swissblock analysts called the conditions for starting the altcoin season. Experts believe that traders need to monitor the ETH/BTC price ratio, which is the price of Ethereum in Bitcoin equivalent. The growth of the ETH/BTC pair is traditionally considered a harbinger of an influx of capital into alternative

Additionally, Technical Analyst Titan of Crypto also expressed faith in the upcoming altseason in April.

According to him, the altcoin market is ready for significant growth. Analyst emphasized that the phase after the BTC halving usually becomes a turning point for them. Technical charts suggest altcoins will soon take center stage, foreshadowing a potentially lucrative altseason.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News