The cryptocurrency market experienced a predominantly bearish trend last week. Bitcoin (BTC), the leading asset, saw its price decline by 4%. Most major tokens followed suit with quite similar movements, although a few lesser-known cryptocurrencies managed to defy the downturn.

Amid widespread market pressure, the global cryptocurrency market cap decreased by 0 million, representing a 4.7% decline. It dropped from .54 billion at the start of the week to .42 billion by the week’s end.

Here are our picks for some of the top cryptocurrencies to watch this week, based on their recent performances:

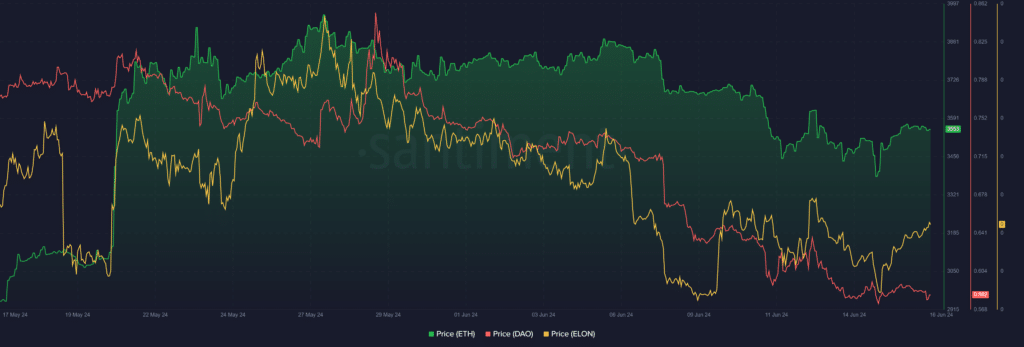

ETH retests lower Bollinger Band

Following a drop two weeks back, Ethereum (ETH) began last week with a slight uptick. It close June 9 above ,700 with a mild 0.69% increase.

However, this rise met fierce resistance. ETH recorded price slumps in the days that followed, leading to a retest of the lower Bollinger Band. The last time Ethereum retested the lower Bollinger Band was during a downturn in mid-May.

ETH dropped 4.6% on June 11, marking its largest intraday decline since April 30. This was due to a sharp decline in the broader market ahead of last week’s FOMC meeting. ShayanBTC, a CryptoQuant analyst, projected more dips for ETH if its bearish futures market metrics do not improve.

These further drops materialized, leading to a retest of ,362 on June 14. However, a mild rebound has pushed ETH back above ,500. Despite the renewed bullishness, the crypto asset must close above the 20-day SMA (,690) to slip out of the bearish trend.

DAO hits yearly low

DAO Maker (DAO) was one of the biggest losers last week, witnessing a 7.9% price slump despite a bullish start to the week. DAO’s decline, which trailed the bearish trend in the global crypto market, saw the asset relinquish the .6 territory for the first time this year.

After a 1.97% increase on June 9, DAO saw four consecutive intraday losses, slumping by 10% within this period and breaking below .60 to .5707, its lowest price this year. The last time DAO traded underneath .60 was in October 2023.

However, due to the sharp drop, DAO’s daily Relative Strength Index (RSI) has slipped to 25.61, suggesting that the asset is currently undervalued at the current .5822 price. Consequently, a bullish trend reversal could be in the works.

ELON records 7% weekly gain

Dogelon Mars (ELON) is our third pick on this week’s top cryptocurrencies list.

It was one of the few assets to defy the broader market downtrend, having recorded a 7% weekly gain. While the market saw a mild rise on June 9, ELON gained by a massive 9.49%.

However, this surge met a roadblock at the .0000001985 high, resulting in two days of consecutive declines. The asset saw mixed trends, witnessing declines and upswings, but leveraging a growth in investor interest to remain above .00000018.

Despite the uptrend, ELON remains significantly below the 50-day EMA at .0000002018. It collapsed below this pivotal moving average during the downtrend two weeks back. The asset would need to recover the .0000002 region to have a chance at flipping its momentum to bullish.

Dogelon Mars has no direct relation to Tesla CEO and X owner Elon Musk. The ELON token now has more than 151,600 holders, according to Etherscan.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News