Pepe token price has risen for two consecutive days in a high-volume environment as traders bought the dip.

Pepe price is recovering

Pepe (PEPE), the third-biggest meme coin, was trading at $0.0000081 on Wednesday, up by over 38% from its lowest swing on Monday when stocks and most cryptocurrencies tumbled by double digits.

Its price action has mirrored that of other tokens like Stacks (STX), Bonk, and Solana (SOL), which have all formed a hammer pattern, one of the most popular reversal signs in the market.

Pepe had the highest volume among all meme coins, rising to over $1.43 billion, higher than Dogecoin’s (DOGE) $1.03 billion and Shiba Inu’s (SHIB) $356 million.

However, Pepe’s recovery faces a few key risks. First, it is happening in a low futures open interest environment. Its interest stood at just $71 million, down from July’s high of over $141 million.

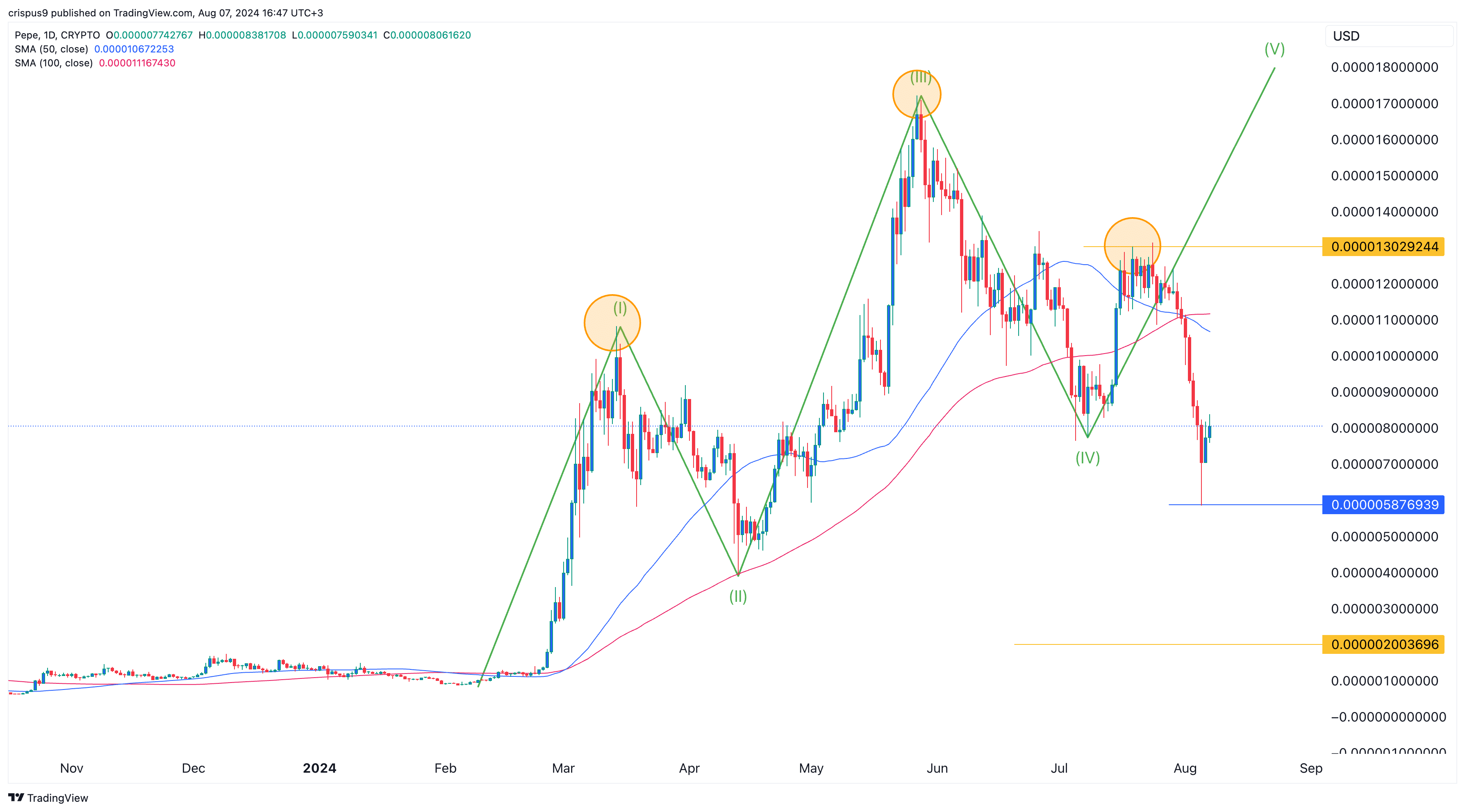

Second, the token has formed a few bearish chart patterns that could hinder its recovery. The most important one is the head and shoulders pattern. It recently dropped from the right shoulder level at $0.000013 and crossed the slanted neckline at $0.0000066.

Therefore, if the current recovery turns out to be brief or a dead cat bounce, there is a risk that Pepe could drop to as low as $0.0000020, which is about 75% below its Wednesday levels. This level was selected by measuring the distance between the head and the neckline.

Pepe token invalidated 5th Elliot Wave phase

Meanwhile, Pepe has likely invalidated the impulse Elliot Wave pattern by failing to complete the bullish fifth section.

The other potential risk is the one previously noted on Bitcoin, which could form a death cross pattern, a big bearish sign.

Finally, Pepe remains below the 50-day and 100-day Simple Moving Averages, which have recently formed a bearish crossover pattern. Therefore, the token will likely resume the downward trend and possibly retest this week’s low of $0.0000058. A break below that level will point to more downside.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News