Injective price has crawled back since mid-May as traders watch its ecosystem grow after announcing recent events.

The INJ token rose to and is hovering near its highest levels since April 12. It has rebounded by over 60% from its lowest swing in April. Injective, the financial-focused blockchain network backed by Mark Cuban, recently incorporated PYUSD, the stablecoin launched by PayPal.

In a statement, the developers said that it had become the first layer-1 platform to support the 0 million stablecoin. This integration means that the token can be onboarded from Ethereum and Solana onto Solana.

This integration was made possible by Wormhole, one of the biggest bridging network in the blockchain industry.

Meanwhile, Mito Finance, an upcoming liquidity management platform on Injective, launched permissionless vaults. This launch means that users can create their vaults on Mito and start trading. Already, users have created the GME/INJ, ZIG/INJ, and NLT/INJ in the platform.

Still, Injective’s ecosystem is still significantly smaller than some of its newest peers. According to DeFi Llama, the network has 17 DeFi applications with a total value locked (TVL) of over 9 million. The biggest players in the platform are Hydro Protocol, Dojoswap, Helix, and Neptune Finance.

In contrast, the recently launched Blast network has over .07 billion in assets while Base and Merlin have .68 billion and .17 billion in assets.

Helix, the biggest DEX in the platform, has seen recent success. According to CoinMarketCap, the platform handled over 1 million in transactions in the past 12 hours, making it the 16th largest player in the industry.

A potential catalyst that could help Helix gain market share in the industry is the continued launch and popularity of meme coins. Recently, Solana meme coins like Bonk and Dogwifhat have helped Raydium, Orca, and Jupiter become top-5 DEX networks.

Injective price forecast

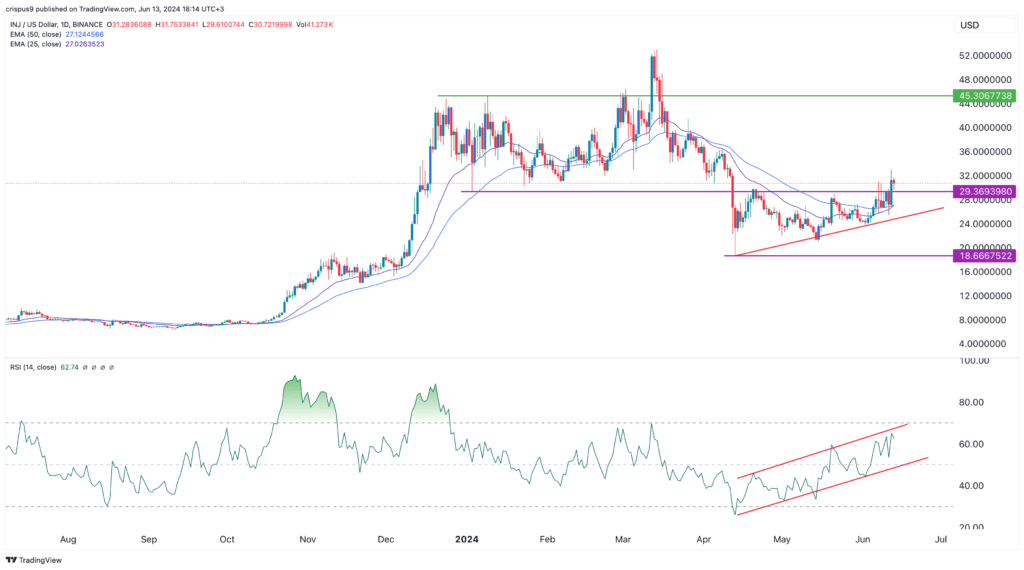

The INJ token bottomed at .66 in April and has now rebounded to over . It has jumped above the crucial resistance point at , its highest swing in April and May and the lowest point in January.

The 25-day and 50-day moving averages have formed a bullish crossover while the Relative Strength Index (RSI) has formed an ascending channel shown in red.

Therefore, the token’s outlook is bullish, with the next reference level to watch being at , its highest point on January 9th. This forecast implies a 46% upside from the current level.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News