Ripple, the popular payment-focused cryptocurrency, is nearing a crucial level ahead of the upcoming RLUSD stablecoin launch.

Ripple (XRP) was trading at $0.5850 on Tuesday, Sept. 17, where it has remained for the past few months, giving it a market cap of over $32 billion.

The next big catalyst for the XRP price will be the launch of its stablecoin, RLUSD, which will be backed 1:1 by the U.S. dollar.

Ripple hopes the stablecoin will become a significant player in an industry that has attracted over $172 billion in assets.. Tether (USDT), the largest stablecoin globally, holds over $118 billion in assets. It also generates billions of dollars in revenue, making it more profitable than BlackRock, a company with over $10.7 trillion in assets.

Ripple’s biggest challenge will likely be the competitive nature of the stablecoin industry, where Tether has become highly dominant. Other popular stablecoins Ripple will compete with include (USDC), Dai, and PayPal’s PYUSD.

XRP price will also likely react to the upcoming Federal Reserve decision, which could drive more demand for risky assets. Ripple has historically performed well when the Fed has taken a dovish stance. It surged to a record high of $2.00 in 2021 when the Fed slashed interest rates to zero due to the pandemic. However, it dropped by over 60% in 2022 as the Fed hiked rates.

XRP price nears a crucial level

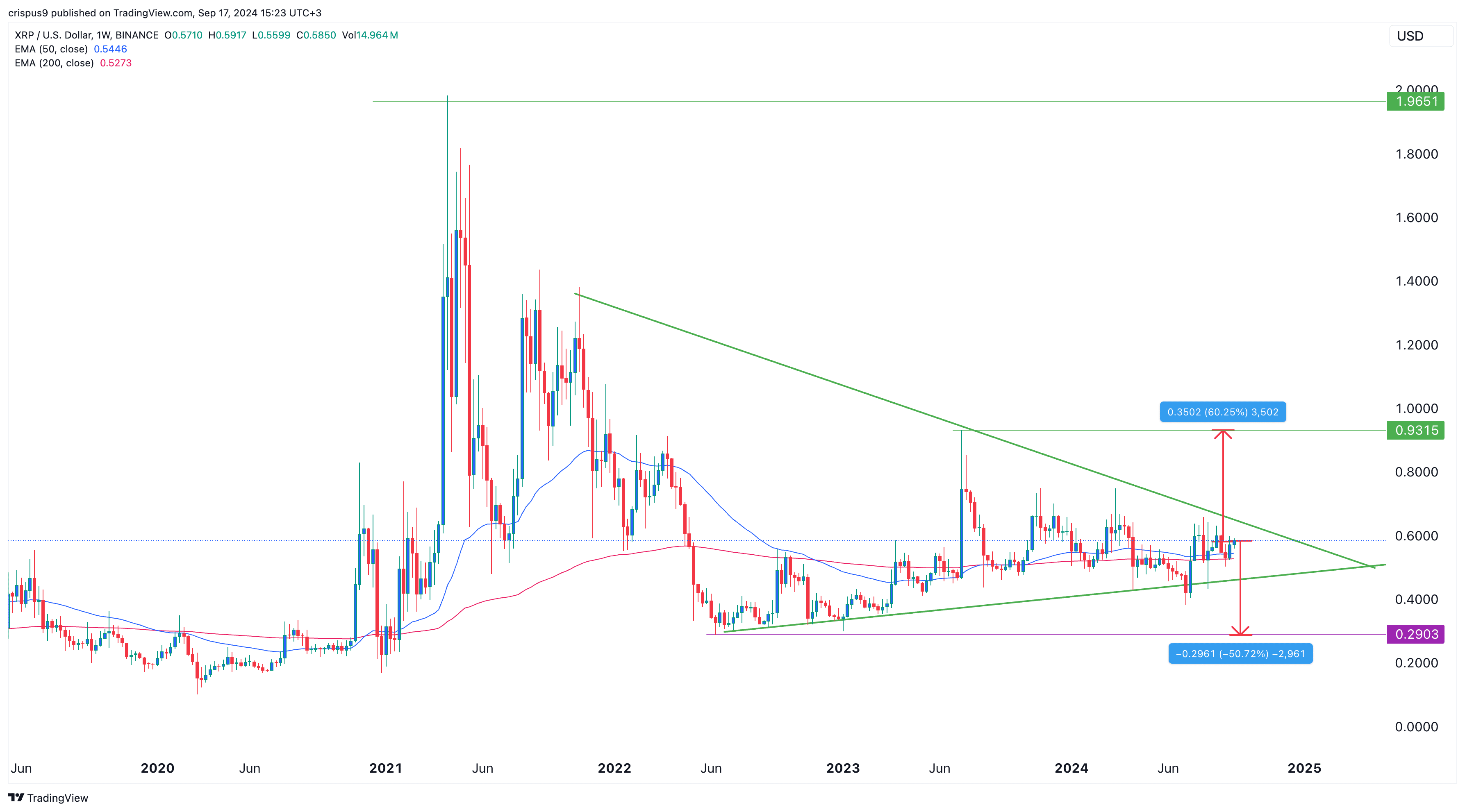

Technically, Ripple has traded sideways over the past few months. This price action has resulted in the formation of a symmetrical triangle pattern, connecting its highest swing since November 2021 and its lowest levels since June 2022.

The two lines of the triangle are now nearing a confluence point. XRP has also moved slightly above the 50-week and 200-week exponential moving averages, while the accumulation/distribution indicator is pointing downward. It has also formed a bullish flag on the monthly chart.

Therefore, Ripple is likely to make a significant move in the next few weeks. A volume-supported breakout above the upper side of the triangle could push it to the psychological level of $0.9315, its highest swing in July 2023, which is 60% above the current level.

Conversely, a strong drop below the lower side of the triangle could see it fall to the next support point at $0.2900, its lowest swing in June 2022 and 50% below the current level.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News