Circuits of Value (COVAL) has witnessed a deep dive in its value as the Coinbase crypto exchange decided to suspend trading for the asset.

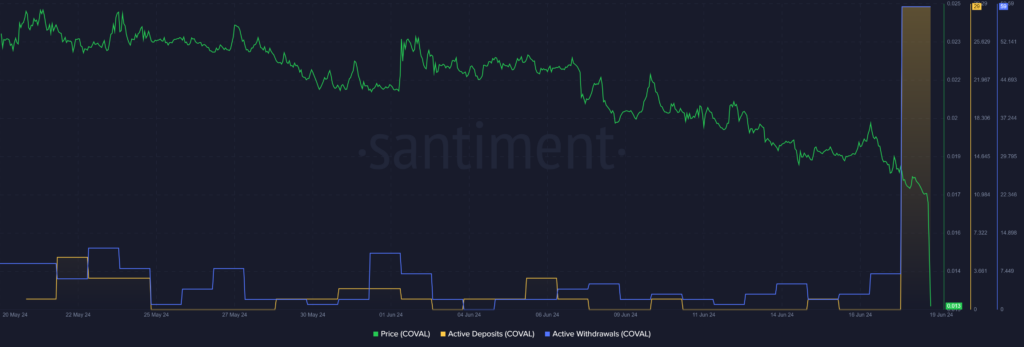

COVAL plunged by 41% in the past 24 hours and is trading at .01 at the time of writing. The asset’s market cap is sitting at .4 million, making it the 892nd-largest crypto. COVAL’s daily trading volume increased by 2,760%, reaching .75 million.

Following the price fall, COVAL is down by 99.99% from its all-time high of 3.01 in January 2022.

COVAL is the native token of the Circuits of Value ecosystem which offers an asset management platform and an exchange. The token was launched on the Ethereum blockchain in early 2015.

The COVAL price plunge comes as some users claim that Coinbase has decided to stop supporting the asset with a notification earlier today. This made many users complain about the exchange’s approach in delisting COVAL with a very short time window.

Coibase did not respond to crypto.news’ immediate request for comment on the matter.

One X user, called Satoshi kakaroto, claims that the team behind COVAL has been involved in the token’s price manipulation.

On March 3, claimed that three Circuits of Value developers drained a huge amount of the token’s supply, calling it a “Pump & Dump” project.

According to data provided by Santiment, the number of COVAL active exchange deposits surged from zero to 29 over the past 24 hours.

Moreover, the number of COVAL active exchange withdrawals increased from seven to 59 over the past day. This shows that investors have been trying to swap or withdraw their COVAL holdings due to the Coinbase delisting.

Tổng hợp và chỉnh sửa: ThS Phạm Mạnh Cường

Theo Crypto News